Oaklo Stock Analysis : Discover why Oaklo (OKLO) is leading the next wave of clean energy with small modular nuclear reactors. Backed by Peter Thiel and Sam Altman, this stock may be the future of zero-carbon power.

📌 Table of Contents

- What is Oaklo?

- Core Technology: Small Modular Reactors (SMRs)

- SMRs vs Traditional Nuclear Reactors

- The Aurora Reactor: Compact, Yet Powerful

- Business Model and Revenue Streams

- Key Customers: From Defense to Data Centers

- Regulatory Approval Status

- Competitor Comparison

- Growth Strategy and Market Positioning

- IPO and Financial Outlook

- Backed by Top-Tier Investors

- ESG and Sustainability

- Nuclear Power Renaissance

- Risk Factors and Mitigation

- Final Takeaway

1. What is Oaklo?

Oaklo Inc. is a U.S.-based clean energy startup designing and developing next-generation nuclear reactors. Headquartered in California, Oaklo collaborates with the U.S. Department of Energy (DOE) and national labs to commercialize the world’s first small, fast reactor for distributed energy generation.

In 2021, Oaklo received approval to build its first commercial reactor “Aurora” at the Idaho National Laboratory (INL), setting the stage for scalable SMR deployment across the U.S. and globally.

2. Core Technology: Small Modular Reactors (SMRs)

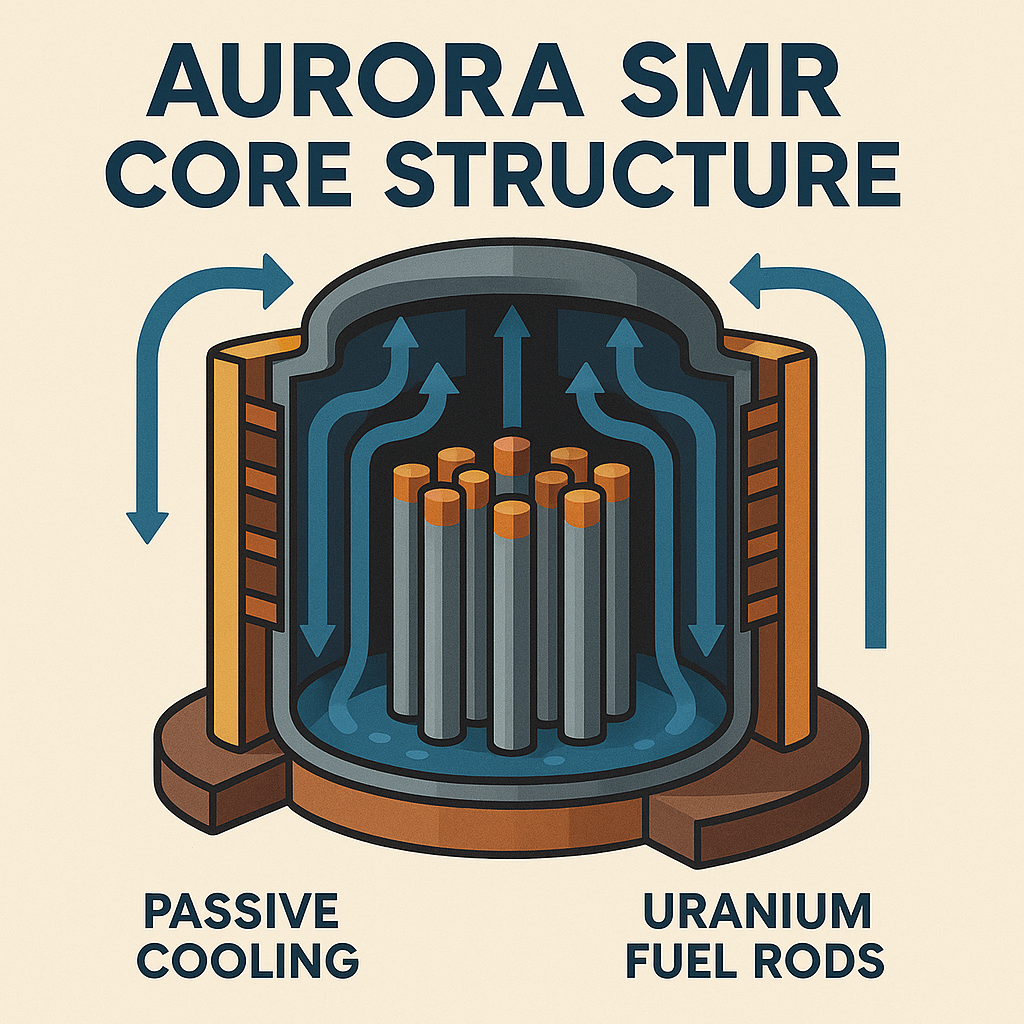

Oaklo’s core innovation is a compact, solid-fuel fast reactor. Unlike traditional nuclear designs, its SMRs offer:

- Long-term autonomous operation: Up to 20 years without refueling

- Passive cooling systems: Automatic thermal stabilization during power outages

- Minimal waste: Enhanced fuel reusability and reduced radioactive output

These features help overcome the cost, safety, and scale limitations of legacy nuclear plants, opening doors to industrial, military, and space applications.

3. SMRs vs Traditional Nuclear

| Feature | Traditional Nuclear | Oaklo SMR |

|---|---|---|

| Power Output | Hundreds to 1,000+ MW | 1–15 MW |

| Footprint | Large-scale sites | Container-sized units |

| Cooling | Water-based | Air & passive conduction |

| CAPEX | $Billions | Under $100M |

| Waste | Large, centralized | On-site or recyclable |

Oaklo’s SMRs complement renewable energy sources, providing stable baseload power crucial for grid resilience.

4. The Aurora Reactor: Compact, Yet Powerful

Aurora is Oaklo’s first-generation commercial SMR, designed for simplicity and efficiency.

- Output: Up to 15 MW (enough for ~1,500 homes)

- Fuel: HALEU (High-Assay Low-Enriched Uranium)

- Size: Fits in 2–3 standard containers

- Operation: Up to 20 years on a single fuel load

Aurora aims to begin commercial operation in 2026 as the first privately licensed SMR in the U.S.

5. Business Model and Revenue Streams

Oaklo isn’t just a power plant operator. Its hybrid infrastructure-energy model targets high-value enterprise use cases:

- PPA Contracts: Long-term deals with Google, DoD, and utilities

- On-site deployment: For data centers, mines, oil rigs

- Heat & hydrogen generation: Combined output for industrial zones

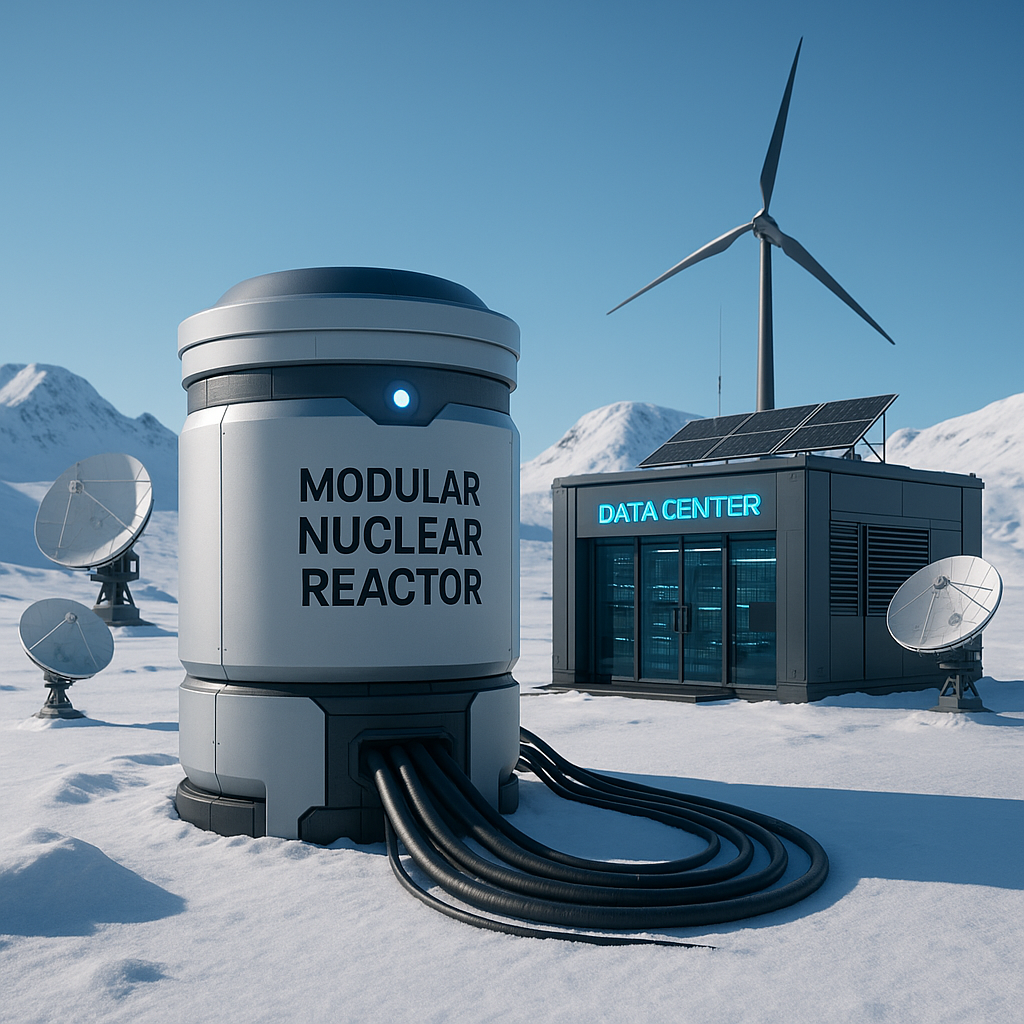

6. Key Customers: From Defense to Data Centers

Oaklo’s SMRs are ideal for clients needing autonomous, local power:

- U.S. Department of Defense bases

- Remote data centers and critical infrastructure

- Arctic research outposts and space operations

7. Regulatory Status

In 2020, Oaklo submitted its Aurora design to the U.S. Nuclear Regulatory Commission (NRC). As of 2024, it has passed Phase 1 review and is on track for final approval in early 2025—potentially becoming the first-ever privately approved SMR in U.S. history.

8. Competitor Comparison

| Company | Tech | Commercial Date | Highlights |

| Oaklo | Fast solid-fuel SMR | 2026 | Autonomy, recyclability |

| TerraPower | Sodium-cooled SMR | 2028 | Funded by Bill Gates |

| NuScale | Light-water SMR | 2029 | Requires large infrastructure |

Oaklo is ahead in commercial readiness and excels in modularity and waste reduction.

9. IPO and Financials

Oaklo went public in 2024 via SPAC merger, ticker OKLO.

| Metric | Value |

| IPO Valuation | ~$1B |

| Expected Revenue (2024) | $5M–$15M |

| Break-even Target | Post-2028 |

10. Top Investors

- Peter Thiel (Palantir Co-founder)

- Sam Altman (OpenAI CEO)

- Khosla Ventures

- DOE grants and SBIR funding

11. ESG Alignment

Oaklo addresses core ESG criteria:

- Net-zero power output

- Low-waste reactor design

- Labor-saving autonomous operations

12. Nuclear Renaissance

Energy security crises, war-driven instability, and net-zero mandates are driving a global nuclear resurgence. U.S., EU, and Asian policies increasingly favor SMRs—and Oaklo is leading the pack.

13. Risk Factors

- Tech delays → Offset by DoD-first deployment

- Policy risk → Bipartisan SMR support in U.S.

- Cash burn → Backed by grants and multi-year contracts

14. Conclusion

Oaklo is more than a nuclear startup. It’s a platform company targeting energy, defense, and climate markets with scalable SMRs. Its first-mover status and strong institutional backing position it as a leader in the future of distributed power.

✅ Summary: Why Buy Oaklo Now?

- Pioneer in commercial SMRs

- First private SMR demonstration in the U.S.

- Strategic customers in defense and tech

- Full ESG compliance with climate mandates

- Backed by elite investors and government programs

#Oaklo#OKLOStock#SMR#SmallModularReactor#CleanEnergy#NuclearInnovation#NextGenPower#ZeroCarbon

#PeterThielInvestments#FutureOfEnergy